|

October 2011

Article

AutomatedBuildings.com

|

[an error occurred while processing this directive]

(Click

Message to Learn More)

|

|

Let's Get Small

That’s

where the future potential of the building automation and control

systems market is – small buildings automation.

|

|

In

the August 2002 issue of automatedbuildings.com, I wrote an article

titled “Does Size Really Matter”. One of the key aspects of the article

was a focus on the overall size and composition of the commercial

buildings market here in the United States. That information, as it

turned out, was not very difficult to come by at all. Starting in 1979,

the U.S. Department of Energy’s Energy Information Administration has

been conducting a survey, the Commercial Buildings Energy Consumption

Survey or CBECS, that provides us with very useful data. The CBECS

collects information on the stock of U.S. commercial buildings, their

energy-related building characteristics and their energy consumption

and expenditures. Commercial buildings include all buildings in which

at least half of the floorspace is used for a purpose that is not

residential, industrial or agricultural, so they include building types

that might not traditionally be considered "commercial," such as

schools, correctional institutions and buildings used for religious

worship. The target population of the survey consists of all commercial

buildings in the United States with more than 1,000 square feet of

floor space. Unfortunately, the results of the last CBECS, conducted in

2007, will not be made public. The following statement from the EIA

addresses the reason for this:

“EIA regrets to report that the 2007 Commercial Buildings Energy

Consumption Survey (CBECS) has not yielded valid statistical estimates

of building counts, energy characteristics, consumption and

expenditures. Because the data do not meet EIA standards for quality,

credible energy information, neither data tables nor a public use file

will be released.“

[an error occurred while processing this directive]A review of the 2003 data will still provide a very relevant picture of

the size and composition of the commercial buildings market for us.

The numbers from that survey are fairly staggering. The survey results

listed the number of commercial buildings present in the year 2003 at

4.86 million. Those buildings comprised a total of 71.6 billion square

feet of floorspace. Approximately 2.6 million buildings were in the

smallest size category (1,001 - 5,000 ft²) with another 948,000

buildings in the next larger category (5,001 - 10,000 ft²). Simple math

tells us that 3.5 million of the 4.86 million total, or roughly 72% of

the total, are less than 10,000 ft² in size. This is precisely the

reason I say “Let’s Get Small”. Make no mistake about it, that’s

where the future potential of the building automation and control

systems market is – small buildings automation.

Armed with that specific knowledge, manufacturers should be focused on

developing, if they haven’t already, products that can deliver today’s

cutting edge technology to this segment of the commercial buildings

market. These products should be priced to make their deployment

economically feasible. It seems reasonable to assume a building owner

isn’t going to invest $15,000 or more into a system for his 3,000 ft²

building - no matter what the “bells & whistles” look and sound

like. These products should also be fairly simple to set up and use and

not require proprietary software and licenses in order to work. The end

game is to give the building owner a simple, affordable and highly

functional product which will allow him to maximize his use of the

product and, subsequently, get the most return on his investment.

Manufacturers who can deliver these types of products should be very

successful in getting their fair share of this market. Fortunately,

there are already manufacturers who have recognized the opportunity

that the small buildings automation market presents, have started down

this path and are providing these solutions. Here are just a few

examples of products that are available right now:

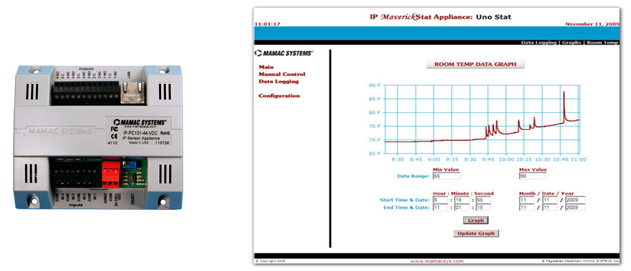

MAMAC Systems: Maverick

The Maverick family of products are IP addressable network appliances

available in a number of different configurations. Typical equipment

control applications {which can be based on setpoint, time schedule or

both} for the Maverick include heat pumps, PTACs, RTUs and split

systems. The Maverick can also be used in monitoring only applications,

like server rooms, “walk in” refrigerator/freezer boxes and

building/tenant electrical consumption and demand. Launch any web

browser, enter the default IP address and connect to the appliance.

There is no proprietary software or license needed in order for the

product to work. The Maverick serves up static web pages with dynamic

data updates every second or two. The above example is an actual data

logging page served up by a Maverick thermostat controller appliance.

The product is specifically targeted to the small buildings market in

price but not in performance. Every model of the Maverick presently

available is less than $500.00. The building owner can harvest useful,

real time data from the Maverick, be in total control of his

environment and receive alarm notifications via e-mail when there is a

problem. Fast food locations, retail stores, bank branches, “portable”

classrooms in school districts, library branches and churches are just

some of the typical small buildings that can benefit from the

installation of this product. There are case studies available on the

manufacturer’s website.

KMC Controls: FlexStat

The FlexStat is an intelligent, wall mounted thermostat/controller. It

also happens to be a native BACnet Advanced Application Controller

{B-AAC} as well. The FlexStat requires no proprietary software or

license to setup and operate. The FlexStat comes with an on board

library of programs for a variety of applications: heat pumps, fan coil

units, rooftop units and air handling units. Menu screens allow for the

user to easily configure the FlexStat using the buttons on the front of

the FlexStat. There are humidity and motion sensing options available

as well as inputs for adding an outside air temper-ature sensor and fan

status sensor, for example. The FlexStat also provides the building

owner with the future option of networking these products together

{BACnet MS/TP} for integration into a “front end”, or graphical user

interface. Any location where a commercial programmable thermostat

would be considered for installation, like restaurants, small

commercial office buildings and churches, would be a candidate for a

FlexStat. A comparable FlexStat is more expensive than a high end

commercial programmable thermostat but provides more features. Typical

price range is $250.00 to $400.00 for a FlexStat, dependent on the

model.

The FlexStat is an intelligent, wall mounted thermostat/controller. It

also happens to be a native BACnet Advanced Application Controller

{B-AAC} as well. The FlexStat requires no proprietary software or

license to setup and operate. The FlexStat comes with an on board

library of programs for a variety of applications: heat pumps, fan coil

units, rooftop units and air handling units. Menu screens allow for the

user to easily configure the FlexStat using the buttons on the front of

the FlexStat. There are humidity and motion sensing options available

as well as inputs for adding an outside air temper-ature sensor and fan

status sensor, for example. The FlexStat also provides the building

owner with the future option of networking these products together

{BACnet MS/TP} for integration into a “front end”, or graphical user

interface. Any location where a commercial programmable thermostat

would be considered for installation, like restaurants, small

commercial office buildings and churches, would be a candidate for a

FlexStat. A comparable FlexStat is more expensive than a high end

commercial programmable thermostat but provides more features. Typical

price range is $250.00 to $400.00 for a FlexStat, dependent on the

model.

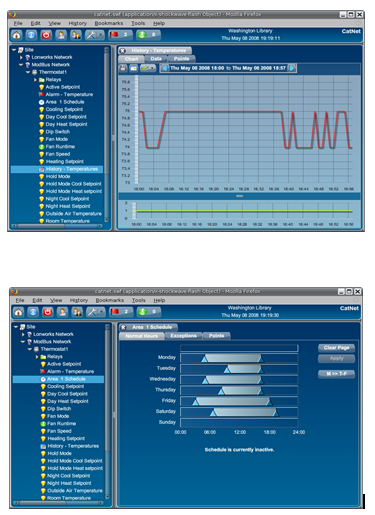

CatNet Systems: CatNet HMI CH-1

The CH-1 is a self contained, Adobe Flash® based server that provides a

graphical user interface for products that use an assortment of

communicaton protocols. The CH-1 comes equipped with BACnet/IP, BACnet

MS/TP, Modbus I/P, Modbus RTU {RS485} and LON drivers. Animated graphic

screens, scheduling, trending, alarm notification via e-mail and

runtime accumulation are just some of the features available in the

CH-1, as seen in the following screen captures.

The CH-1 is a self contained, Adobe Flash® based server that provides a

graphical user interface for products that use an assortment of

communicaton protocols. The CH-1 comes equipped with BACnet/IP, BACnet

MS/TP, Modbus I/P, Modbus RTU {RS485} and LON drivers. Animated graphic

screens, scheduling, trending, alarm notification via e-mail and

runtime accumulation are just some of the features available in the

CH-1, as seen in the following screen captures.

No proprietary software or license, nor knowledge of HTML, XML, Flash,

JavaScript or any other programming language, is required to set up and

use the CH-1. With the CH-1 and some inexpensive input/output modules,

a comprehensive system that can control HVAC equipment and lighting,

for example, can be deployed by the building owner. Another example

would be the addition of a CH-1 to a network of KMC FlexStat

con-trollers initially installed to work in stand alone mode. The CH-1

would “web enable” the network of FlexStat controllers and provide the

owner with all of the additional features that the CH-1 offers. Typical price range for the CH-1 is $900.00 to $1,000.00.

No proprietary software or license, nor knowledge of HTML, XML, Flash,

JavaScript or any other programming language, is required to set up and

use the CH-1. With the CH-1 and some inexpensive input/output modules,

a comprehensive system that can control HVAC equipment and lighting,

for example, can be deployed by the building owner. Another example

would be the addition of a CH-1 to a network of KMC FlexStat

con-trollers initially installed to work in stand alone mode. The CH-1

would “web enable” the network of FlexStat controllers and provide the

owner with all of the additional features that the CH-1 offers. Typical price range for the CH-1 is $900.00 to $1,000.00.

Hopefully, we will continue to see new, innovative products

targeted for this market. As long as the products are made readily

accessible, easy to setup and

operate and provide real value for a reasonable price it should prove

to be an interesting future for the small buildings automation market.

About the Author

Frank Miraglia, Vice President, FMS2K Associates, Inc.

Founder and principal consultant Frank Miraglia officially

launched FMS2K Associates, Inc. in March of 2003 in order to provide

the demanding, rapidly evolving controls market with the quality

products and services needed to sustain and propel its seemingly

limitless growth potential. As a multi-faceted company, offering a

combination of state of the art products, consultative services and

training seminars, FMS2K Associates, Inc. is uniquely qualified to

provide your business with the solutions necessary to achieve both

present and future success.

footer

[an error occurred while processing this directive]

[Click Banner To Learn More]

[Home Page] [The

Automator] [About] [Subscribe

] [Contact

Us]